when you need them

Core banking

The core banking module provides different account types, keeps records of the transactions made on the accounts, and allows creating and enabling of prices for the transactions. It also includes an option to manage deposits and currency rates.

- The account management API supports the complete account life cycle. It also includes the capability to manage virtual IBANs

- Transaction management API manages the registration of an increase or decrease in the account balance in the transaction currency

- A comprehensive pricing model that allows creation of customised pricelists and sets conditions for how the fees are calculated

- Term-deposits feature and supports the deposit contract lifecycle

- The currency exchange and pricing API supports registration of FX deals with sell and buy transactions and the calculation of FX markup and FX gain/loss

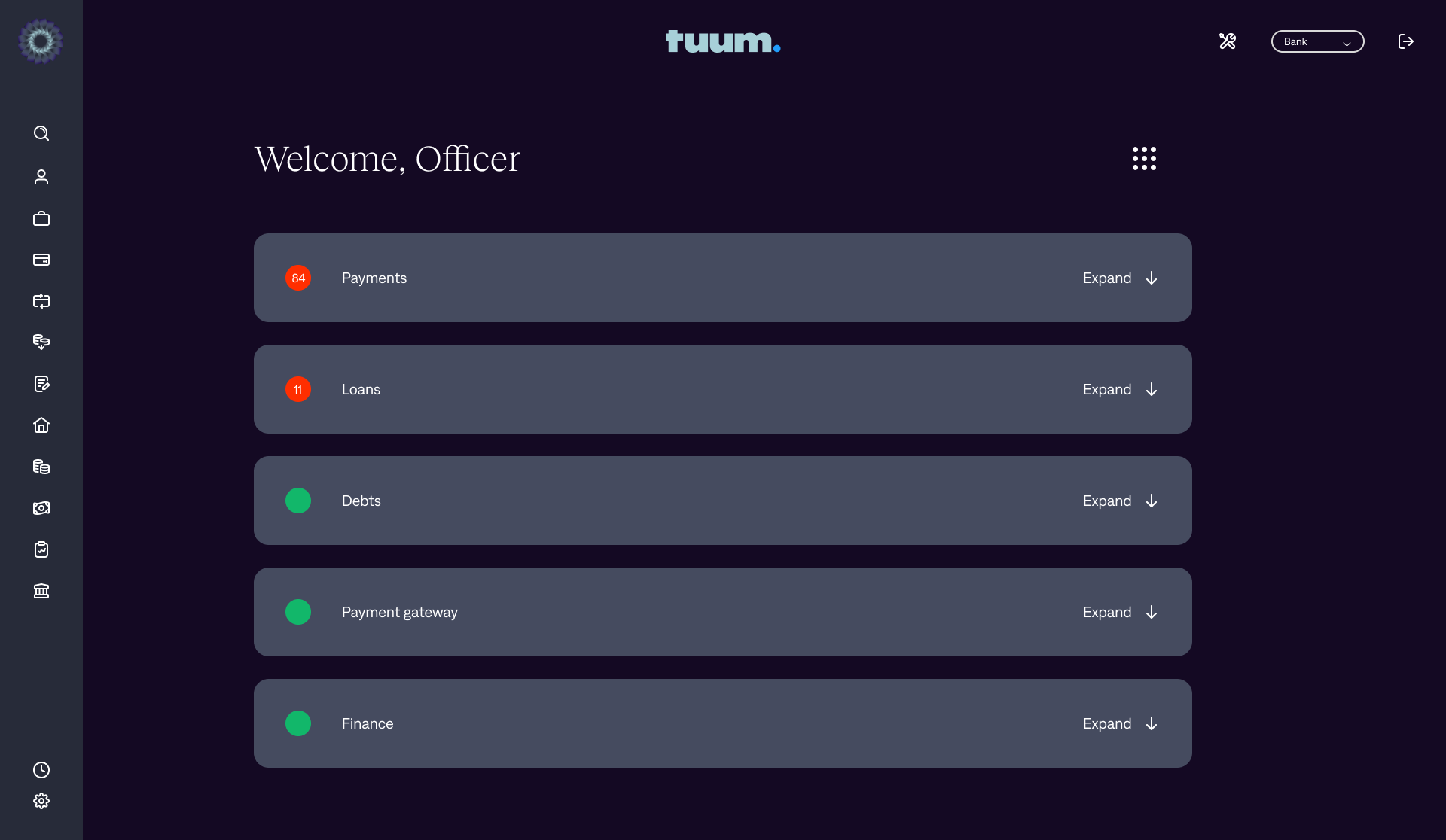

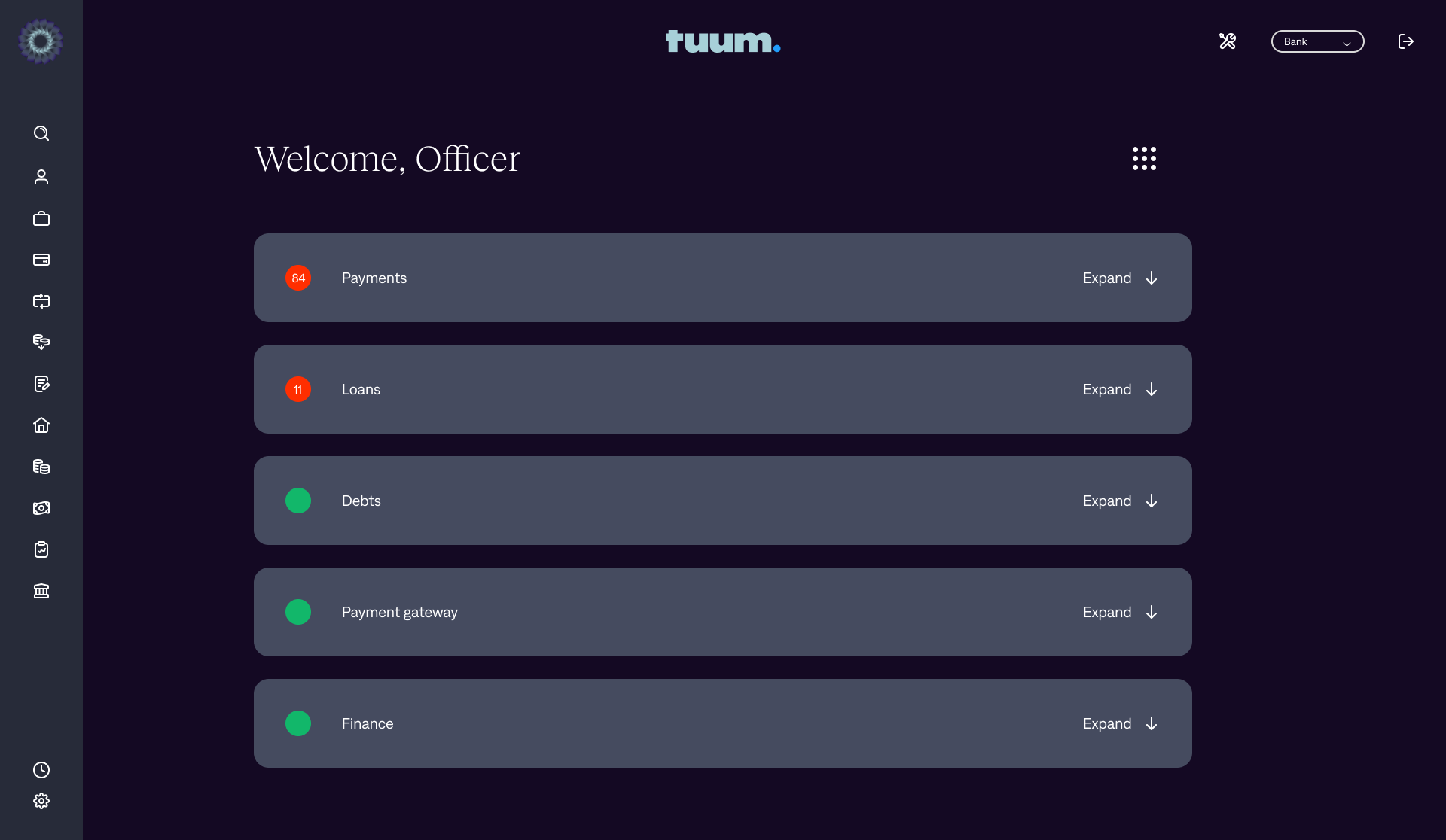

Payments

The payment module provides capabilities to initiate and validate payments according to specific payment formation rules like SEPA, SWIFT, and also several local payment rules. It also incorporates automated payment processing and settlement via different payment service providers as per requirements.

- Dedicated API to initiate and validate payments according to specific payment formation rules

- Automatic payment processing and manual corrective actions if automated processing fails

- Automated checks, resolving AML-halted payments via the BackOffice interface

- A set of integrations with smart routing capabilities between different settlement service providers to facilitate outgoing payments and receiving incoming settled payments

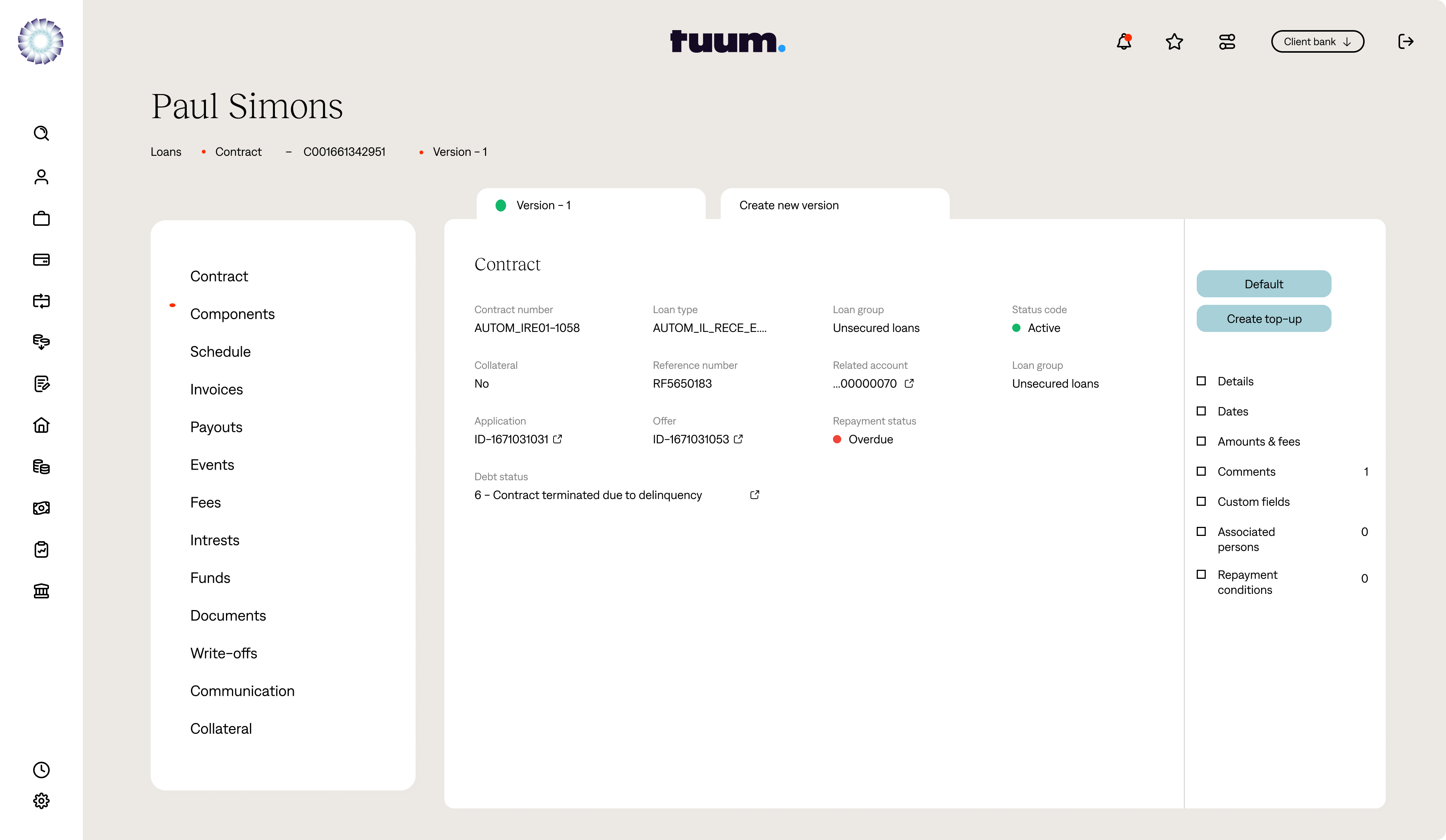

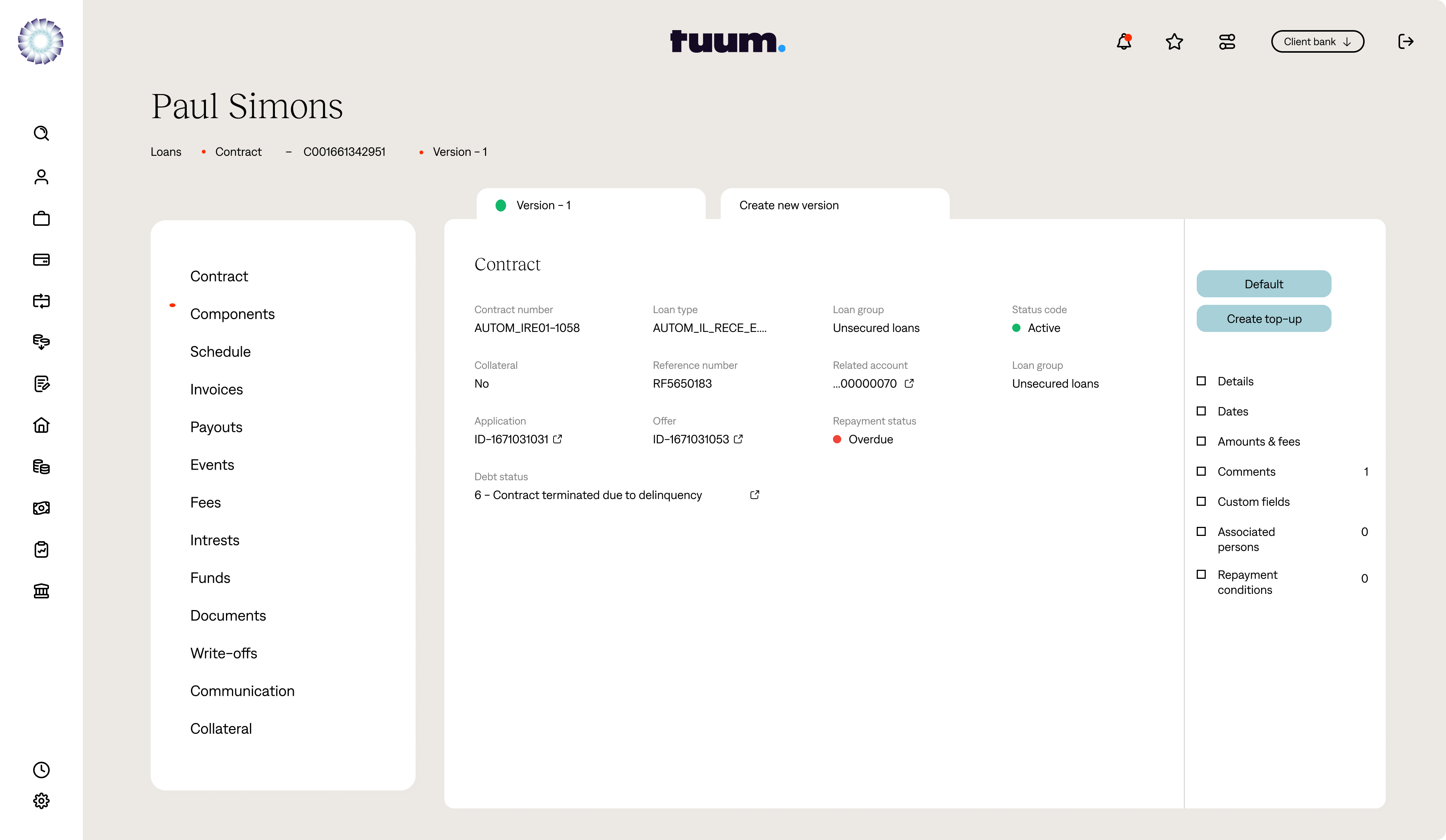

Lending

The lending module facilitates a three-step loan management process consisting of loan application, loan offer and loan contract. This module also allows for setting up and managing different loan products. Additionally, the customers can enhance the loan module capabilities with the optional debt and collateral management APIs.

- Loan product management API enables to configure and manage different loan products. In addition, offers different loan types, interest calculation methods, and product-specific fee & penalty configurations

- Loan application and offer generation API enables creating, editing, accepting and rejecting loan applications and offers

- Loan contract management facilitates and manages the loan contract lifecycle

- The collateral API includes asset registration, calculation and management of collateral usage and availability, and relationship management between loan products, different asset types and customers

- The debt API includes overdue invoice registration and tracking, initiation of debt notifications, and contract debt status calculation

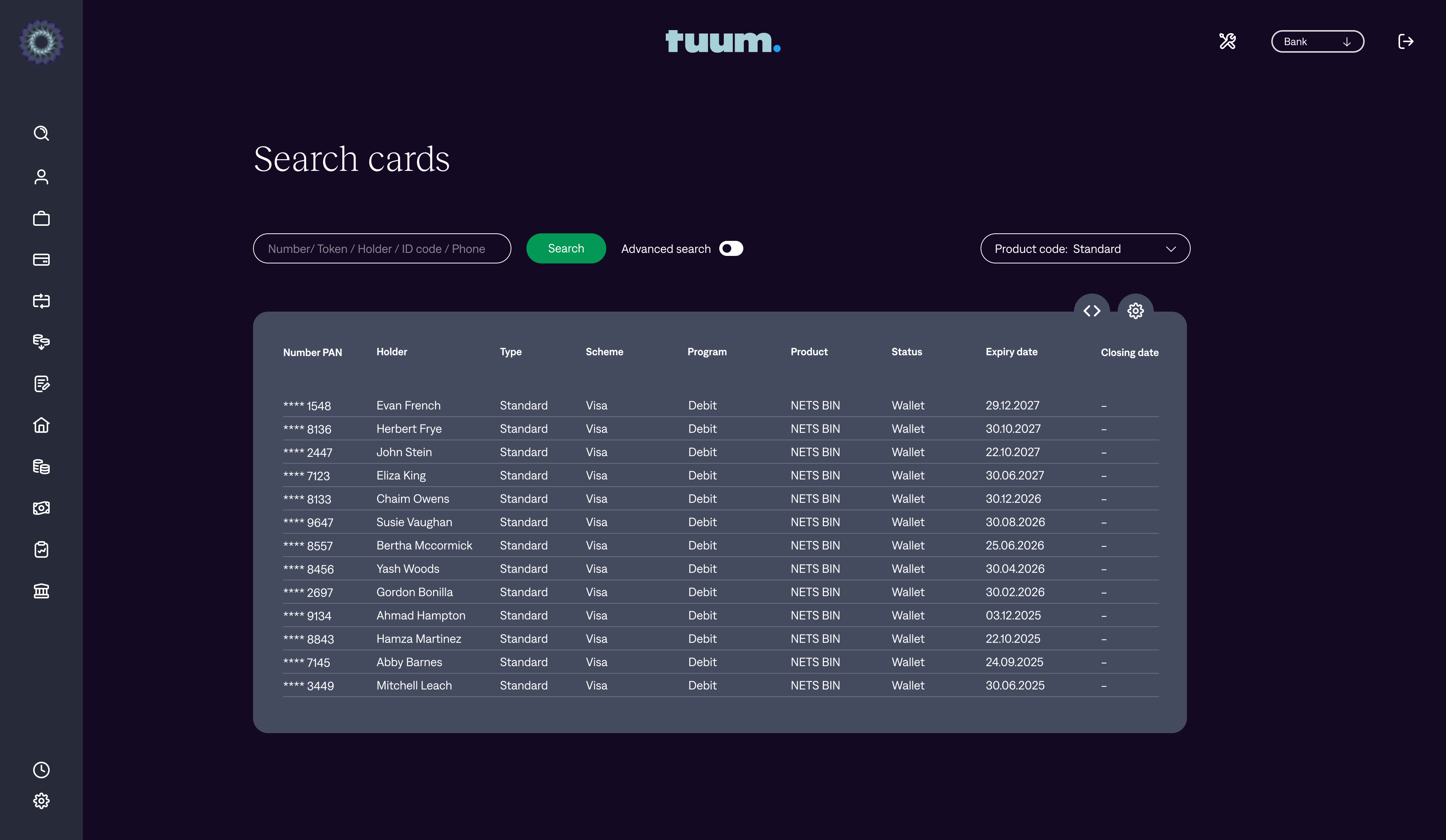

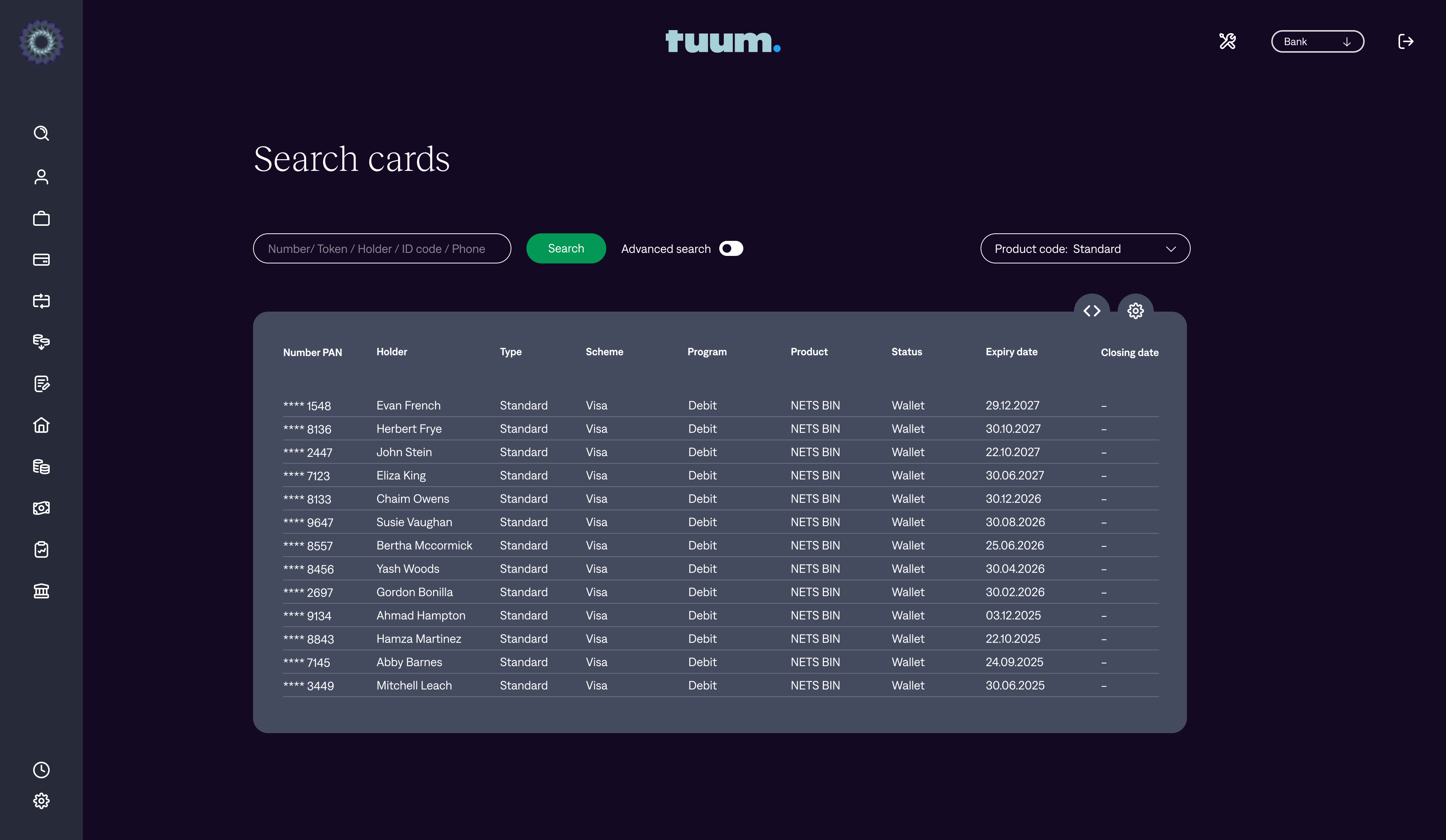

Cards

The card module facilitates issuing of debit and credit cards. It includes the ability to define card products by enabling a specific set of features for the card user. By default, the card module is integrated with Tuum's banking core, but it can also be integrated with other core banking solutions via APIs.

- Card lifecycle management for different card types, as well as card issuer management and configuration

- Creating custom price lists and cards fee management

- Card transaction processing and handling clearing files

-

Built-in connector for card processing services and also the ability to integrate a card processor of the customer’s choice

- Credit contract management for credit card

- Instalment plans for credit card purchases

Don’t miss out!

Subscribe to Tuum’s monthly newsletter

Build, expand, and scale with Tuum

Write us a line and find out how to transform your business with us