Personal and business lending represent a huge opportunity for banks and fintechs alike, growing from $7887.89 billion in 2022 to $8682.26 billion in 2023 at a compound annual growth rate (CAGR) of 10.1%. Competition is fierce, but there is also plenty of potential in underserved markets such as SME lending and unarranged overdrafts. Tuum’s Lending Module gives businesses the competitive edge they need to win in this space.

The ability to launch and configure secured and unsecured loan products with ease is key. Consumers today demand a diverse and ever-evolving range of products, and meeting these needs has never been more complex. A low-code/no-code approach, combined with advanced analytics, considerably reduces the workload for simplified testing, iterations, and targeted product roll-outs.

With Tuum, there is no limit to the number of innovative loan products you can test and launch via our carefully designed APIs – see for yourself!

Read on:

- Deep dive: Tuum’s lending module

- Tuum helps CrediNord on their mission to reinvent business lending in Europe

Improved efficiency, improved experience

Tuum’s lending module has been built to improve efficiency across the entire loan product lifecycle. Advanced management and credit scoring capabilities can be set up with ease, making lending decisions more informed than ever before. Additionally, it enables the automation of certain lending processes, thus reducing the need for manual intervention.

For end customers, applying for a loan has never been more straightforward. Our platform enables you to build a seamless customer journey, improving stickiness and supporting your customers when they need it most. All of this can be built in as little as 48 hours!

Save your settings

The process of launching a new loan product is typically cumbersome: repayment terms, interest rate calculation, penalty fees, etc. When dealing with legacy systems, the establishment of loan terms and conditions has to be carried out every time a new account is opened. With Tuum’s master product setup, you can apply your chosen terms and conditions to all products – set it and forget it.

Of course, terms and conditions can also be changed as and when needed down to each individual account. No coding required, simply configure the settings within the back office.

Clone products with a click

Need to duplicate a loan product? Rather than having to go through the process of starting a new product from scratch, you can simply clone an existing product with a few clicks. Tuum’s platform enables you to significantly cut down on the workload, reduce development costs, and free up resources.

Configure with ease

Launching new lending products and scaling a lending portfolio has never been more simple thanks to Tuum’s highly configurable low-code/no-code approach. Products can be tested, launched, and improved with ease. Additionally, you can make use of our custom fields to generate reports and extract the exact data you need to make loan management, compliance, and auditing decisions.

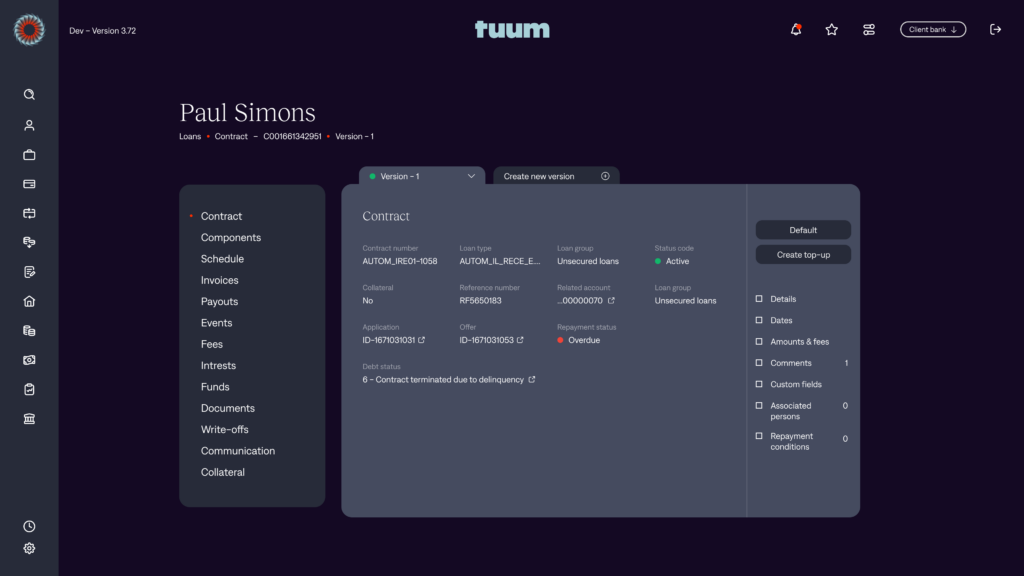

Contract versioning

Circumstances change, and sometimes contracts will need to change to reflect that. With Tuum’s contract versioning functionality, a new contract can be created with just a few clicks and without the need for creating new IDs or instances.

Embedded lending

Use our APIs and connectors to integrate lending products into your business and take advantage of the embedded finance opportunity. Offer customers products like Buy Now, Pay Later (BNPL) and revolving credit lines at the point of sale, allowing them to stay inside the buying journey because the whole process (loan application, verification and approval, credit, and repayment) is digital.

Get in touch to find out more.